Egon von Greyerz, founder of VON GREYERZ, is a globally respected authority on wealth preservation and risk management. With decades of experience navigating financial crises and currency debasement, he is known for his uncompromising views on protecting capital outside the fragile banking system.

In this message, von Greyerz delivers a stark warning about the coming collapse of bubble assets and explains why, in his view, real wealth can only be preserved through ownership of physical gold and silver.

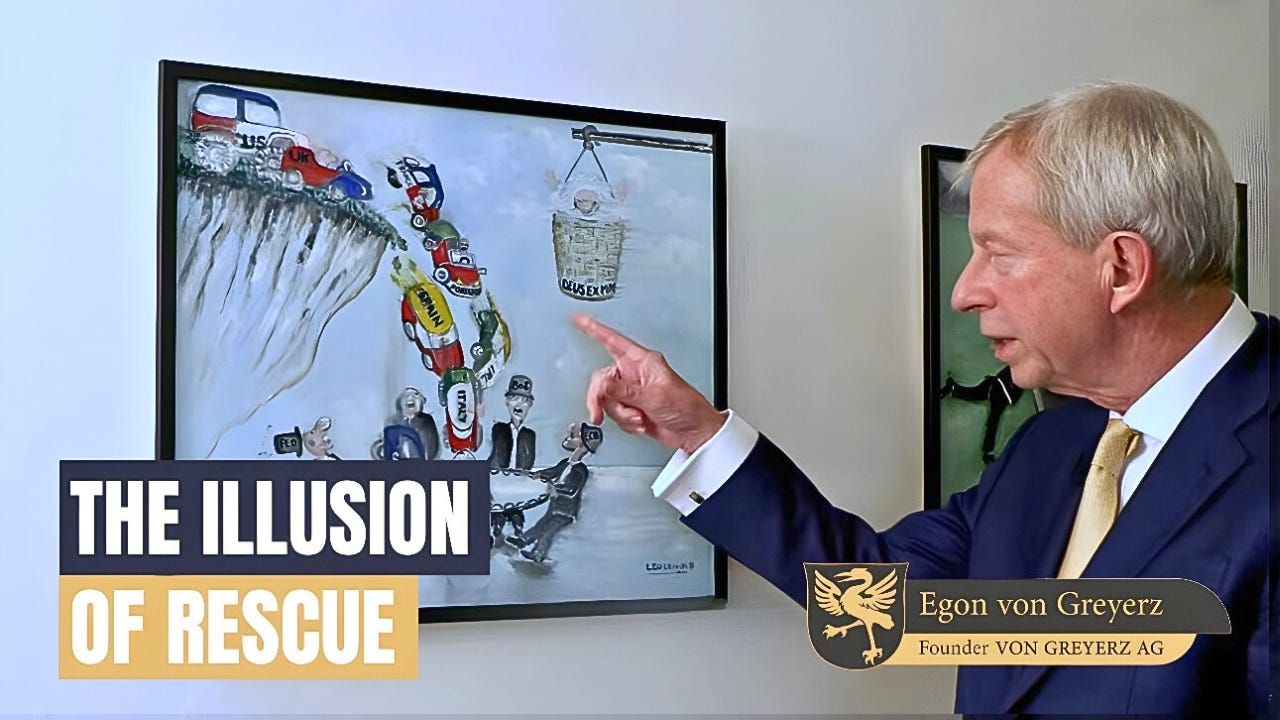

A picture often tells a story more clearly than words.

Throughout history, moments of great crisis have always inspired attempts to explain, justify, or disguise what is really happening beneath the surface. The painting Deus Ex Machina is one such attempt — an allegory of a world on the brink, waiting for a miraculous rescue.

In 2008, that rescue appeared to arrive. Central banks stepped in, printed unprecedented amounts of money, and convinced the world that collapse had been avoided. In reality, it was not solved — only postponed.

KEY INSIGHTS

00:00 – 00:14 | When Art Explains the World

A single image can explain the state of the world and the global economy better than words.

00:14 – 00:47 | “Deus Ex Machina” – The Illusion of Rescue

Deus Ex Machina means “God out of the machine” — a miraculous last-minute solution.

The painting symbolizes central banks stepping in during crises to “save” the system.

Created at the start of the 2008 Global Financial Crisis.

00:47 – 01:24 | 2008: System on the Edge

Western economies were collapsing; Europe first, the US and UK close behind.

The global financial system was minutes from collapse.

Central banks temporarily saved it by intervention and coordination.

01:24 – 01:56 | Collapse Postponed, Not Solved

The system should arguably have collapsed in 2008 due to excessive debt and derivatives.

Instead, central banks printed trillions, delaying the collapse.

Since then, debt and systemic risk have grown exponentially.

01:56 – 02:26 | Money Printing and Asset Bubbles

Massive money printing destroyed currency value.

Gold reflected this debasement through rising prices.

Stocks, bonds, and property became unsustainable bubble assets.

02:26 – 02:50 | The Scale of the Problem Today

Global debt: ~$350 trillion.

Derivatives (including shadow banking): ~$2 quadrillion.

Today’s crisis is far larger and harder to manage than 2008.

02:50 – 03:11 | No More Safety Net

This time, central banks will not be able to intervene successfully.

Falling economies will not be “caught.”

Risk of the largest financial collapse in history.

03:11 – 03:33 | Shift from Paper to Real Assets

Asset prices will fall sharply.

Capital will move from paper assets to real assets.

Real assets include gold, silver, and resources in the ground.

03:33 – 03:47 | Historic Wealth Destruction Ahead

The world is unprepared.

The largest wealth destruction in history is coming.

Events will unfold sooner than most expect.

03:47 – 04:04 | Wealth Preservation, Not Speculation

Preserve wealth in gold and silver, held outside the banking system.

Remaining in stocks and bonds risks massive loss of purchasing power.

Relative to gold and silver, stock markets (e.g. Dow Jones) could fall 90% or more.