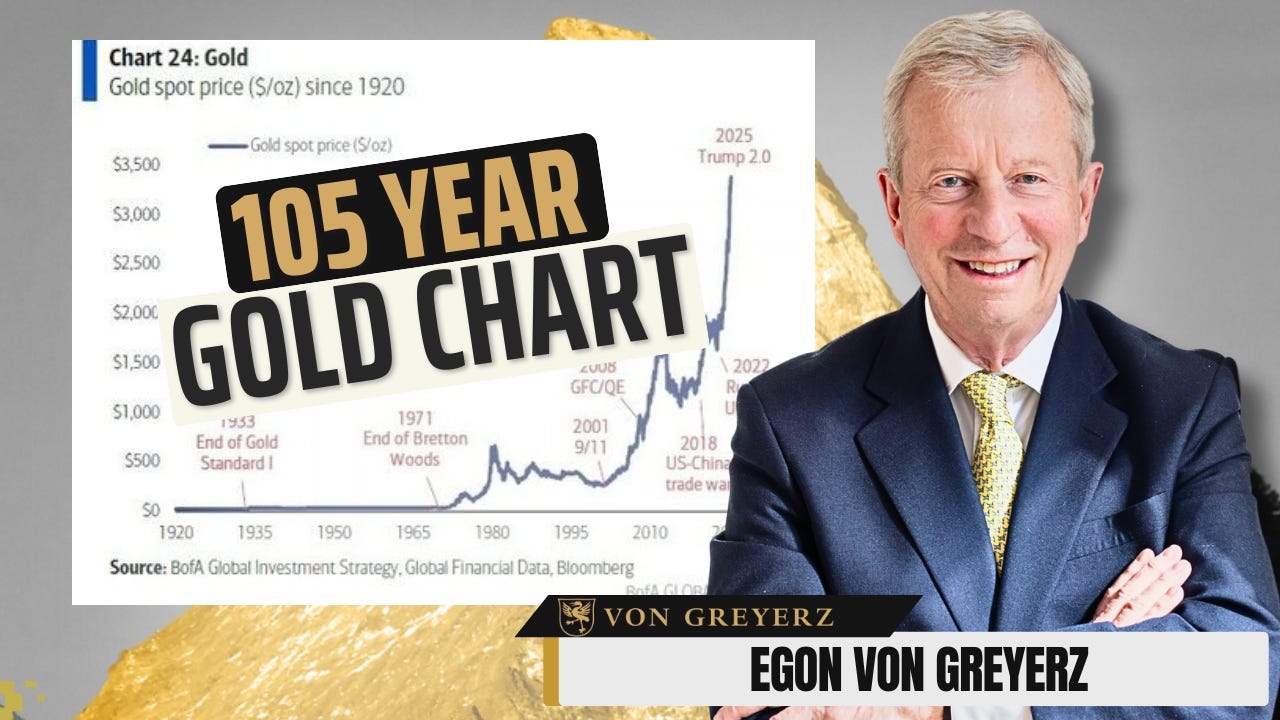

Gold has increased 15,000% since 1920. But this is a fallacy.

Gold buys the same amount today as it did 2,000 years ago, a quality suit, for example.The illusion is not in gold rising, but in the dollar collapsing.

In this powerful and sobering analysis, Egon von Greyerz lays bare the illusion of rising gold prices. What appears to be a dramatic increase in gold's value is in fact:

“The collapse of fiat currencies”

Gold has not appreciated, it has merely preserved purchasing power as government currencies have systematically eroded. Drawing from over a century of economic history, von Greyerz dissects the death of money, the illusion of growth, and the impending collapse of the current financial system.

Key Insights:

00:00 – A Century of Gold Price Movement: A Misleading Chart

Gold has increased 15,000% since 1920. But this is a fallacy. Gold buys the same amount today as it did 2,000 years ago—a quality suit, for example. The illusion is not in gold rising, but in the dollar collapsing.

“Turn the chart upside down. It’s not gold rising—it’s fiat falling.”

00:44 – Every Currency in History Has Died

The pattern is consistent across 5,000 years: Every fiat currency has gone to zero. The dollar is not immune. We are now at the end of another monetary era, and signs abound—debt escalation, deficits, currency debasement, geopolitical chaos.

01:43 – Nixon's Fatal Blow: End of the Gold Standard

The removal of gold backing in 1971 was a watershed. Nixon blamed foreign “speculators”, but they simply recognized the dollar’s devaluation. From $35 to $850 by 1980, gold revealed the collapsing confidence in paper money.

03:17 – Inflation and the Loss of Trust:

Inflation isn’t just rising prices—it reflects the destruction of money’s value through relentless currency printing. Governments blame price increases, but the root cause is monetary debasement.

“Inflation means the value of your money going down… governments will never admit that.”

04:10 – The Weaponization of the Dollar: A Turning Point

The confiscation of Russia’s dollar reserves in 2022 marked a critical loss of trust. Central banks began shifting reserves out of dollars and into gold.

“Why hold reserves in a currency that can be frozen at the whim of another nation?”

05:07 – Massive Misallocation of Capital

Microsoft alone is worth as much as all the gold held by central banks worldwide. This highlights the enormous mispricing of real assets versus bubble assets.

“We are witnessing the biggest wealth destruction in history.”

06:28 – Interest Rates, Bonds, and the Great Reset

The bond market, in von Greyerz’s view, will go to zero. This would force interest rates to rise exponentially, driving inflation higher and destroying debt-laden economies.

“Interest rates in the teens will return—just as in the 1970s.”

07:00 – A Mere 0.5% of Global Wealth in Gold

Gold represents a tiny fraction of global financial assets. As paper collapses and confidence erodes, institutional money will chase a finite supply of gold, triggering exponential revaluation.

“It’s not the paper price of gold that matters—but the weight you hold.”

Conclusion:

As the current monetary system nears collapse, gold stands as the only enduring form of money. While currencies disintegrate, and paper assets implode, gold—nature’s money—will remain the ultimate preserver of wealth. Investors must act before the exponential phase, not during.

“Gold has no counterparty risk. It is not a promise to pay—it is payment.”

Share this post