Silver is entering a significant new phase

Silver is breaking out fast. A historic shift is underway—here’s why we’re increasing silver now. Volatility brings opportunity, and silver may soon lead the next explosive leg in precious metals.

For 25 years, Egon von Greyerz' views on precious metals have been entirely based on simple fundamentals; physical gold is a long term store of value in the face of exponentially growing debt and the inevitable debasing of Fiat currencies via endless printing of money.

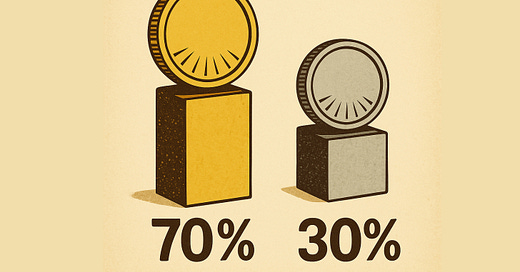

For most of this period, we have advised clients to own gold/silver in a ratio of 80/20 or 85/15, depending on the period. This is to reflect gold always being the king of money and the much higher volatility associated with silver.

In recent weeks, however, Egon von Greyerz and Matt Piepenburg have been advising clients to hold more silver vs gold; so a ratio of 70/30.

This small shift in allocation is to reflect silver’s extreme value we see vs gold.We have argued that the next leg in this precious metals secular bull market could be explosively led by silver catching up with gold.

Given how much tighter and smaller the silver mkt is vs gold, the size and speed of the move is likely to surprise.

The following 3 charts, courtesy of MSA, illustrate why last week was technically significant for silver as it broke through $35.

MSA rightly flag that after a year of corrective momentum action, and what amounted to sideways price action, silver has now demonstrably broken out.

We stopped giving price targets years ago but there is no reason now why silver can’t move quickly to $50 and possibly as high as $100 in due course.

The 3rd chart below is particularly interesting.

It simply shows the silver price as a % of the gold price.

In 21 yrs, over the past 50 yrs, the price of silver has reached 2% of the price of gold.

Given the increasing tailwinds from the fundamentals now combined with strong technical support, there is no reason to think the spread can’t return to the long term norm of 2%.

And that alone would lead to a doubling of the value of silver vs gold.

For these reasons, we think the time is right to increase allocations to silver now.

For UK investors specifically concerned about the Labour govt’s spending plans in a stagnant economy (ie yet more govt borrowing and higher taxes), silver Britannia coins (like gold Britannias) produced by the Royal Mint are CGT free in unlimited size and we can of course assist with the buying and storage.